Do you remember the days when we used to have piggy banks? Dropping every chillar we found around the house in it? Yes, that is how we went about saving back in the day. And guess what? We inherited the habit from our close circle who happen to save their money in the same pattern, except they save their money in bank accounts.

There is a common notion that saving is also an investment for the future, but the truth is, IT’S NOT. People often confuse savings with investing. Oftentimes, when it comes to savings, people think of it as an emergency fund or for retirement. In reality, be it emergency funds or retirement savings, you must find opportunities that allow your money to grow while also meeting your savings needs.

One quick example is, emergency funds can be in the form of gold investments and your retirement investment fund can be made on policies like NPS, PPF, and more.

Over the course of this blog, we will help you understand why investing is important, how and where to invest along with an outlook on investing in India.

Investing in India

India has emerged as one of the fastest-growing economies in the world, offering numerous investment opportunities to both domestic and international investors. The reason is, India’s favorable demographic dividend, improving infrastructure, and pro-business policies make it an attractive investment destination.

As favorable as investments can be in India, how would they benefit you? Why is it a need of the hour for you to invest? What investments actually are?

What is investing?

The purchase of products that are not consumed right away but will be utilized to create wealth down the road is referred to as an investment. An investment in finance is a financial asset that is purchased with the expectation that it will either continue to generate income or be sold at a profit at a later date.

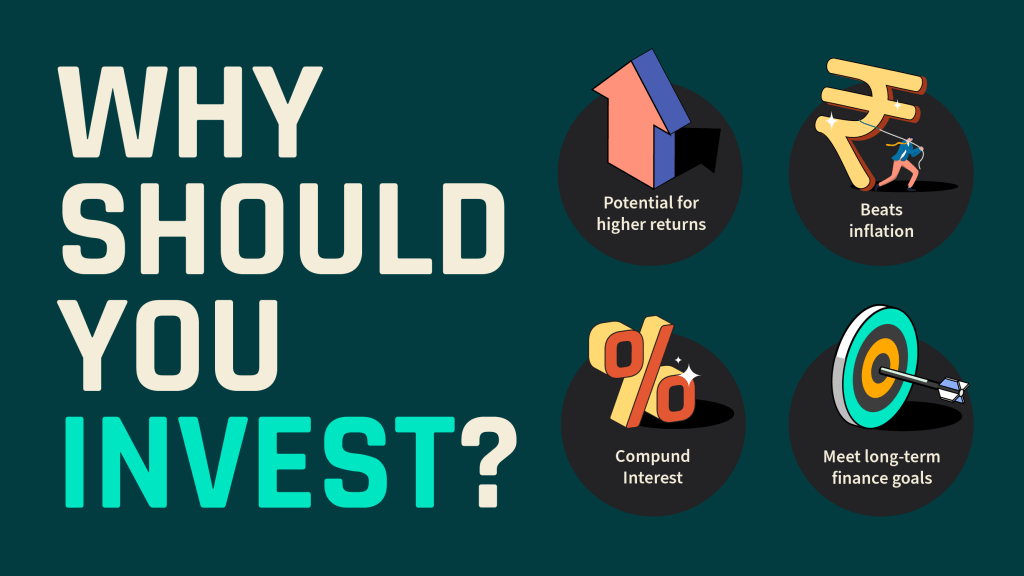

Investing can be a powerful tool to help you achieve your financial goals and build long-term wealth. Here are some reasons why one should consider investing:

Why should you invest?

- Potential for higher returns: Investing in assets like stocks, mutual funds, and real estate can offer higher returns than keeping your money in a savings account or under your mattress.

- Beat inflation: Inflation erodes the purchasing power of your money over time. Investing in assets that outpace inflation can help you maintain the value of your money.

- Compound interest: Investing can enable you to take advantage of the power of compounding, where your returns earn returns over time, helping you grow your wealth more quickly.

- Meet long-term financial goals: Investing can help you achieve long-term financial goals like retirement, paying for your children’s education, or buying a home.

It’s important to remember that investing comes with risks, and the market doesn’t work as per what’s on the books. Speaking about risks, there are quite a few methods of investments that range from low to high risk. Here are the various types of investments you could make in India.

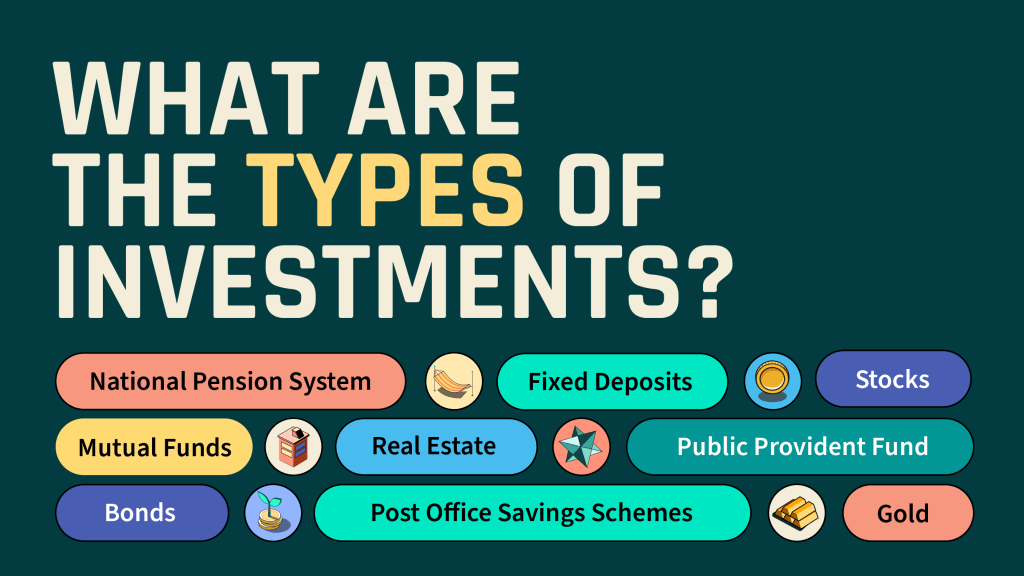

What are the types of investments?

In India, there are quite some options when it comes to investing. One reason is the significant economic growth in recent years. This has led to a rise in disposable incomes and an increase in demand for investment opportunities. On the other hand, in order to reduce risks, the government and financial regulators came up with various other schemes for the diversification of investment.

- Stocks: Investing in stocks is one of the most popular ways to invest in India. Investors can buy and sell stocks of companies listed on the Indian stock exchanges, such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

- Mutual Funds: Mutual funds are a popular investment option in India. Investors can buy units of mutual funds that invest in various asset classes, such as stocks, bonds, and commodities.

- Fixed Deposits: Fixed deposits are a popular investment option for conservative investors. Investors can deposit a lump sum amount with a bank or financial institution for a fixed period and earn a fixed rate of interest.

- Gold: Gold is a popular investment option in India, where it is considered a safe haven asset. Investors can buy physical gold or invest in gold exchange-traded funds (ETFs) that track the price of gold.

- Real Estate: Real estate is a popular investment option in India, especially for those looking for long-term investments. Investors can buy land, apartments, or commercial properties and earn rental income or capital appreciation.

- Bonds: Investors can invest in bonds issued by the government or corporates. Bonds provide a fixed rate of return over a specific period.

- PPF: Public Provident Fund (PPF) is a long-term savings scheme backed by the government of India. Investors can invest in PPF and earn a fixed rate of return while enjoying tax benefits.

- National Pension System (NPS): NPS is a government-backed retirement savings scheme that allows investors to invest in equity and debt markets to build a retirement corpus.

- Post Office Savings Schemes: The Post Office offers various savings schemes, including Monthly Income Scheme, National Savings Certificate, Kisan Vikas Patra, and Senior Citizen Savings Scheme.

With so many options, it might be hard for you to decide which is the right investment plan for you. But, we have a set list of factors you need to consider before investing.

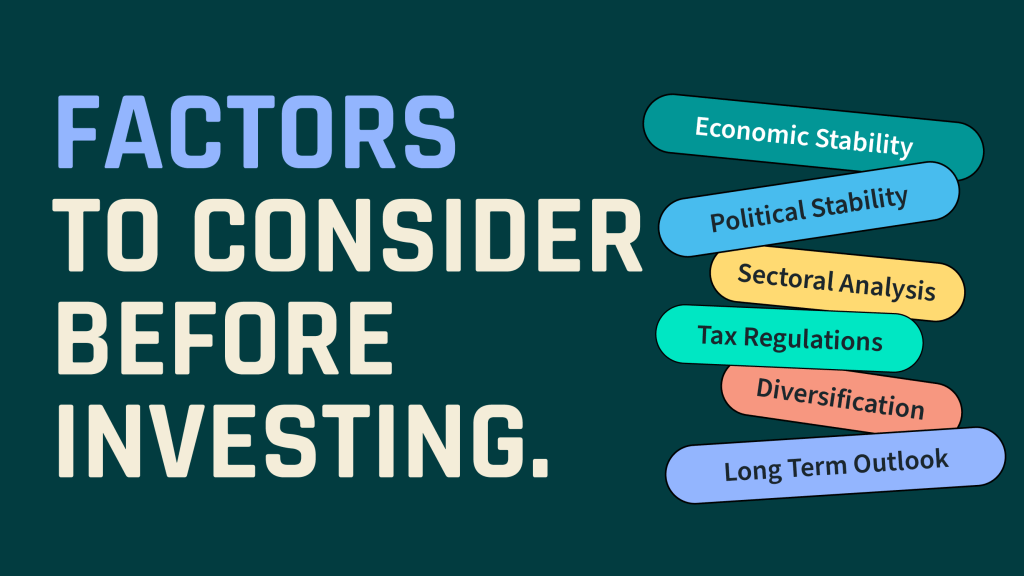

Factors to consider before investing:

- Economic indicators: India’s economic indicators, such as GDP growth rate, inflation rate, and fiscal deficit, should be monitored regularly to make informed investment decisions.

- Political stability: India’s political stability is crucial for long-term investments. Investors should closely watch the government’s policies and regulations to assess their impact on the economy.

- Sectoral analysis: Different sectors in India have varying growth prospects and risks. Investors should conduct a thorough analysis of sectors such as IT, pharmaceuticals, banking, and infrastructure before investing.

- Tax regulations: India has a complex tax system, and investors must understand the tax implications of their investments to avoid any surprises later.

- Diversification: Diversification is key to minimizing risks in any investment portfolio. Investors should diversify their portfolios across different asset classes and sectors to manage risk.

- Long-term outlook: India’s growth story is a long-term one, and investors should have a long-term outlook while investing in India.

Investing in India requires careful analysis and understanding of the country’s economic, political, and regulatory environment. With its growing economy and vast potential, India presents a range of investment opportunities that can yield significant returns for those who are patient and diligent in their approach.

So, are you still not sure where to invest? It is essential that you define your goals with your investment. Ask yourself the following questions.

- Do you want to invest so that you can save up for your retirement?

- Do you want to get a lump sum of money after 5 or 15 years?

- Do you want to have an ever-existing emergency fund?

- Do you want to invest in stocks and shares?

Before making a decision, ask yourself these questions. Make a detailed research on it and how it will be favorable for you.

If you want to play it safe and gain fixed returns, you can go for investment options like PPF, FD, etc. And if you are someone who would like to invest for your retirement, there are a lot of government policies that enable pension and retirement schemes.

On the other hand, if you are someone who is willing to take risks and play around with your money with the expectation to gain higher returns, you might consider investing in well-performing stocks. But investing in stocks requires you to be over the market almost 24/7. Analyzing the crest and trough of market fluctuations is mandatory.

However, it is best to consult a market specialist who could assist you with your investment in stocks and shares. Note: The market specialists will charge you a certain percentage of your investment irrespective of the gains and losses, so it is advised to be mindful.

If you are willing to grow your investment but also have an emergency fund, Digital Gold is for you. They grow with the market value of gold, they come without storage and making charges. Also, they can be cashed-in in less than no time.

Here’s something more exciting. What if you can not only grow your investment with the market value but also by merely playing games? Yes, that’s what Fello helps you with. You can save in Digital Gold, earn game tokens as you save, and use them to play games. You win games and gain rewards. And yes, you can invest the rewards again in Fello assets. Find out more on Digital Gold and start saving today!