When you think about banking, the first few thoughts that pop up are long queues, filling up never-ending forms, and dealing with age-old technologies. On top of this, banking comes with hardships in terms of understanding the intricacies, policies, and regulations.

However, banking in India has gone through a major transformation over the past decade. Along with this, with the liberalization of the Indian economy, the sector has seen significant growth.

In the early ’90s, a major transformation happened with the liberalization of the Indian economy and the advent of technology. This led to the entry of private sector banks and the growth of new-age banks like HDFC and ICICI. Which leveraged technology to offer a new range of financial products and services to the customers.

In this blog, let’s dive deep into the banking sector of India. We will be touching upon topics like the types of banking, the challenges, the benefits, and what the future looks like.

Banking Industry of India

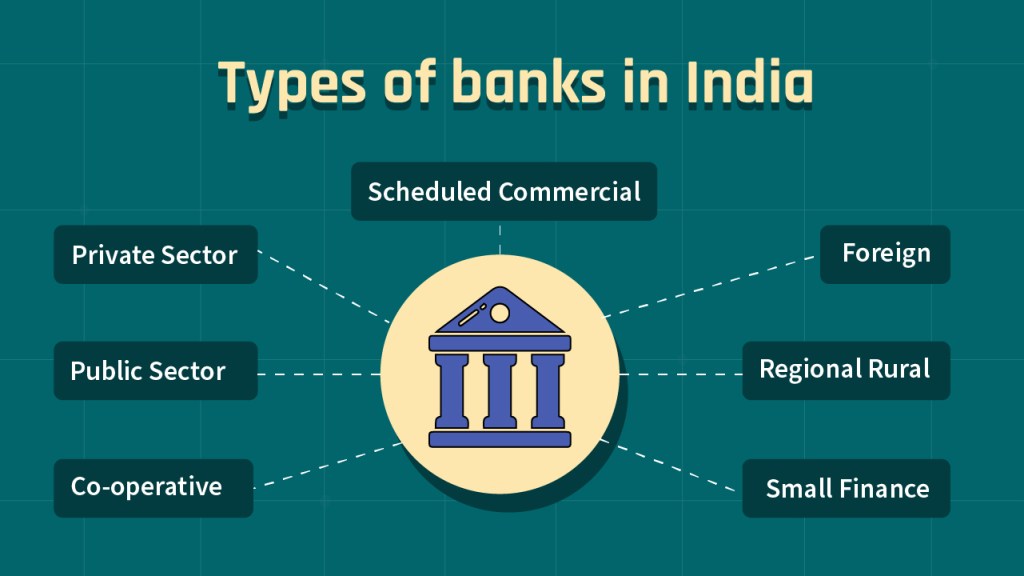

Banking in India is highly regulated by the Reserve Bank of India. The banking sector in India comprises a large number of public sector banks, private sector banks, regional rural banks, foreign banks, cooperative banks, and small finance banks.

As of 2021, the banking industry in India has a total of 27 public sector banks, 20 private sector banks, 56 regional rural banks, 43 foreign banks, and over 1,500 cooperative banks. This explains the competitiveness of the banking sector in India. And guess what’s the currency for the Indian banking sector? Great personalization and quick query resolution.

Here’s a brief list of the types of banks in India:

- Scheduled Commercial Banks: These are banks that have been included in the Second Schedule of the Reserve Bank of India (RBI) Act, 1934. They include both public-sector banks and private-sector banks.

- Public Sector Banks: These are banks that are owned and operated by the government of India. They include the State Bank of India (SBI) and its associate banks, and other nationalized banks like the Bank of Baroda and the Bank of India.

- Private Sector Banks: These are banks that are owned and operated by private individuals or companies. They include HDFC Bank, ICICI Bank, and Axis Bank, among others.

- Regional Rural Banks: These are banks that have been established with the objective of providing credit and other banking facilities to rural areas in India. They are jointly owned by the central government, state governments, and the sponsoring commercial bank.

- Foreign Banks: These are banks that are based outside India and have a presence in India through branches or representative offices. They include Citibank, Standard Chartered Bank, and HSBC, among others.

- Co-operative Banks: These are banks that are owned and operated by a group of individuals who pool their resources to provide credit and other banking facilities to their members. They include urban co-operative banks, state co-operative banks, and central co-operative banks.

- Small Finance Banks: These are banks that have been granted a license by the RBI to provide credit and other banking facilities to unserved and underserved segments, including small businesses, low-income households, and farmers.

Why are banks in place and how you are benefitted from them?

Banks are there to make you manage your finance easier. They basically help the government monetize people’s money, which in turn helps with economic growth by negating inflation. On the other hand, you get to monetize your money as it helps you with detailed statements of your spending.

As a bank account holder, you can easily transfer money to anyone through various types of payment modes available. For example, Credit cards, Debit cards, Cheques, Demand drafts, UPI, NEFT, RTGS, etc.

On the other hand, banks are the primary supplier of credit. They lend money to people to buy cars and homes, expand business operations, and meet payrolls. On contrary, you can also save up your money or invest in stocks, bonds, and mutual funds with the banks, and in return, you get interest on your money, lump sum, and pension based on the scheme you opt for.

Over the past years, investing in RBI-regulated bonds and gold bonds has grown to be the trend. P.S: Digital Gold has grown by 5.7% just over the past year. And there is indeed a reason for it. Buying the yellow metal comes with making charges, storage costs, and importantly the price varies based on geography. However, Digital Gold overcomes all the above challenges.

That’s a brief overview of the benefits that come with banks. Speaking about banks’ benefits, here are the various ways in which you can access banking.

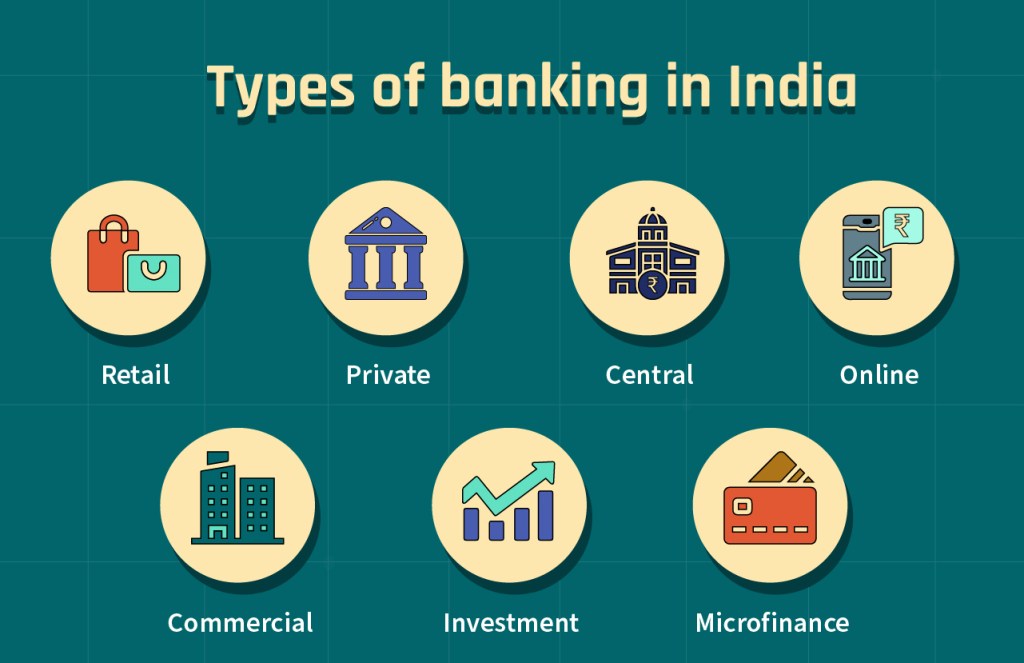

Types of banking in India:

- Retail Banking: This type of banking provides services to individuals and households, including checking and savings accounts, loans, mortgages, and credit cards.

- Commercial Banking: This type of banking provides services to businesses, including corporate loans, working capital financing, and trade finance.

- Investment Banking: This type of banking provides services to corporations and governments, including underwriting securities, issuing bonds, and advising on mergers and acquisitions.

- Private Banking: This type of banking provides services to high-net-worth individuals, including wealth management, private lending, and personalized financial planning.

- Central Banking: This type of banking is responsible for implementing monetary policy and regulating the banking sector. In many countries, the central bank is an independent institution responsible for managing the money supply and maintaining financial stability.

- Online Banking: This type of banking allows customers to access their accounts and perform banking transactions through the internet, including mobile banking and internet banking.

- Microfinance Banking: This type of banking provides financial services to low-income individuals and small businesses, including micro-loans and savings accounts.

India has seen a major breakthrough in adapting to digital technology over the past decade. Although there are various types of banks and banking services, there are still a few hardships people face. And that’s what we will be going through in the following section.

Challenges with Banking in India:

- Non-performing assets (NPAs) and bad loans: Banks in India struggle with high levels of NPAs, which erode their profitability and financial stability.

- Lack of financial inclusion: Despite the efforts of the government and banks, a large section of the Indian population remains unbanked and lacks access to basic financial services.

- Cybersecurity threats: With increasing digitization in the banking sector, there is a growing risk of cyber-attacks and financial fraud, which pose a challenge for banks in terms of protecting customer data and maintaining the security of their systems.

- Competition from non-traditional players: Traditional banks are facing increased competition from new players, such as fintech companies and digital wallets, which are offering innovative and convenient financial services.

- Regulatory compliance: Banks in India have to navigate a complex regulatory environment, which requires them to comply with a large number of rules and regulations while balancing their business interests.

- Lack of infrastructure: Many rural and remote areas in India lack basic infrastructure, such as electricity and internet connectivity, which makes it difficult for banks to expand their services to these areas.

What does the future of banking in India look like?

The future of banking in India is expected to be driven by digitalization and increased adoption of technology. The Indian government pushes for cashless initiatives such as the Jan Dhan Yojana and Digital India campaign. This has led to an increase in digital transactions. And the trend is likely to continue, with more people using digital channels for financial services.

Here’s a staggering stat with regard to UPI. At the end of the calendar year 2022, UPI’s total transaction value stood at INR 125.95 Lakh Cr, up 1.75X YoY.

On the other hand, AI and ML are also expected to play a major role in the future of banking. They can help to enhance risk management, fraud detection, and hyper-personalized customer service capabilities. Additionally, the increased penetration of smartphones and internet access in rural areas is likely to lead to financial inclusion.

Overall, the future of banking in India looks promising. With a focus on innovation, customer-centricity, and increased access to financial services for even the remotest of locations and people.