What is a REIT?

REITs (Real Estate Investment Trusts) are investment vehicles. They own and manage income-producing real estate properties which include apartment buildings, shopping centers, hotels, and office buildings.

Moreover, REITs are trusts or corporations. As per law, they distribute at least 90% of their taxable income to shareholders as dividends. This allows investors to receive regular income streams from the rents and profits. Basically generated by the underlying real estate assets without having to directly own or manage the properties.

Furthermore, investors can buy and sell REITs on major stock exchanges. Just like stocks, mutual funds, or exchange-traded funds (ETFs) that hold a diversified portfolio of REITs.

There are several types of REITs that investors can choose from,

- Equity REITs: These REITs own and operate income-generating real estate properties, such as apartment buildings, office buildings, shopping centers, and hotels. They generate income from rental payments and can also benefit from capital appreciation when the value of their properties increases.

- Mortgage REITs: These REITs invest in mortgage-backed securities or lend money to real estate owners or developers. They make money from the interest on their loans and from the appreciation of the mortgage-backed securities they hold.

- Hybrid REITs: These REITs invest in both income-generating properties and mortgage-backed securities. Their aim is to achieve a balance between income generation and capital appreciation.

- Public Non-listed REITs: These REITs are not traded on stock exchanges and are typically sold through brokers or financial advisors. They are regulated by the SEC and are required to file regular financial reports.

- Private REITs: These REITs are not registered with the SEC and are typically only available to institutional investors or high-net-worth individuals.

- International REITs: These REITs invest in real estate properties outside India. They can offer diversification benefits for investors looking to invest in real estate properties in different regions of the world.

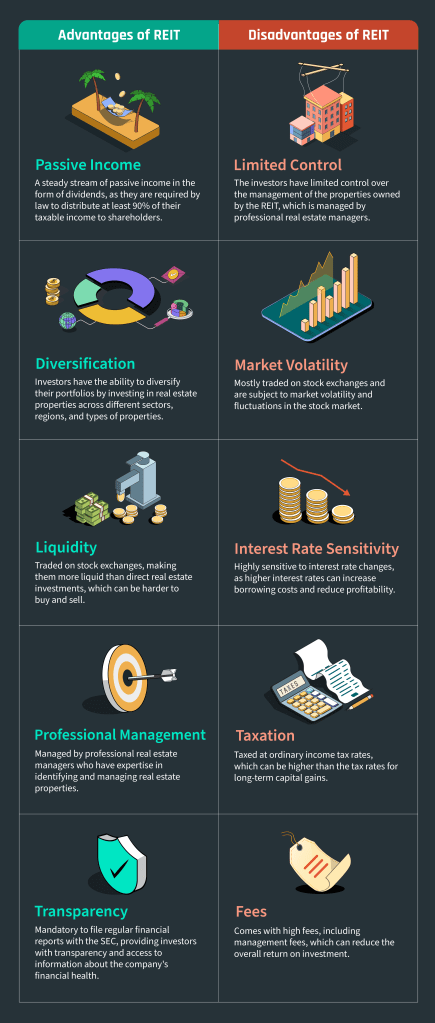

Pros and Cons of REITs

In conclusion, REITs are a good investment vehicle because they not only offer dividends but also offer liquidity to the investor’s portfolio. A steadfast option for great exposure to real estate and real estate trusts.