If the FOMO on investing has caught up with you just in your 30s, the chances are you might feel a bit lost at this point. But let me save you from feeling the angst, it is still not too late. As the famous quote goes, “The best time to have planted a seed was 10 years ago and the second best time to plant a seed is now”, and here’s an example.

4 steps to follow while investing in your 30s

1) Assess your financial situation with life events:

The most challenging aspect of beginning to invest in your 30s is you will have to handle investments along with other family-based commitments. Firstly, be honest with yourself and lay down your expenses and the amount you’d be able to save. This is the mother of all plans which will also help you evaluate your risk appetite.

2) Aspire to build a portfolio that compounds:

Inflation is inevitable and your investments must be ideally beating them. Diversity is strength and having a mix of risky and fixed investments will not only help you compound but also take calculated risks.

3) Sort your goals based on expenses:

Your goals could vary based on what you are able to save from your income. Be it a retirement fund, emergency fund, to pass your wealth to your kids, or to venture into entrepreneurship, it all depends on an individual’s aspirations. Sorting an end goal will lead you toward how you will be achieving it. Let’s segregate investment plans into three types, the first one is to secure your retirement fund.

Retirement Plan:

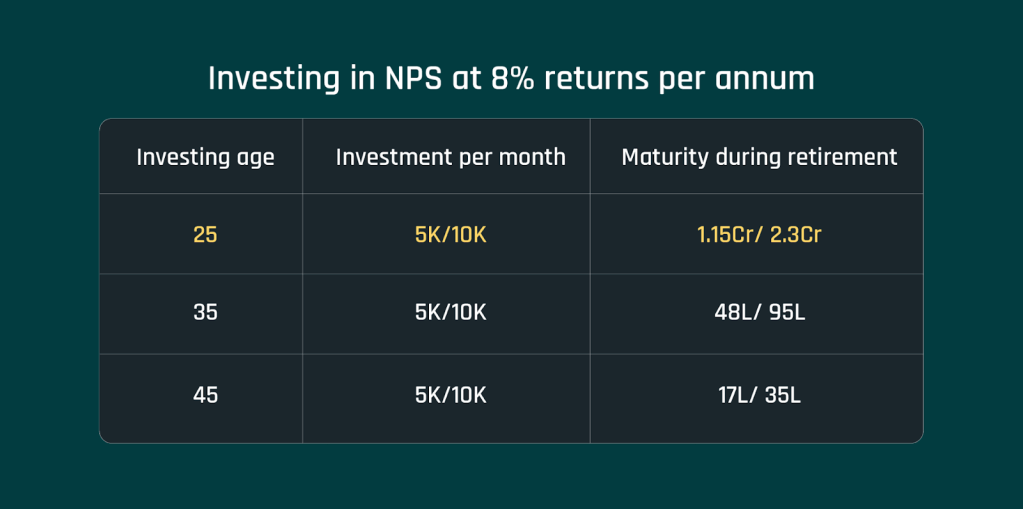

- National Pension Scheme: NPS allows you to make regular and calculated contributions during your working life and the accumulated sum is presented to you post-retirement.

- Real Estate: You can invest in rental properties to secure a place for yourself even after retirement. The rent you pay now can be paid in the form of EMI which will end up making you an owner of the property.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect you with borrowers, allowing you to earn interest on the investments. This provides higher returns than a traditional savings account.

Returns Plan:

- Stocks: You can study the market and gain expertise in terms of the stock market. Buy individual stocks or invest in stock mutual funds or ETFs as they can offer the potential for high returns but also comes with a risk.

- Mutual Funds and Exchange-Traded Funds: These are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. This diversification can help reduce your risk but also maximize your returns when done right.

- Public Provident Fund: Investing in PPF for a period of 15 years will help you with stable 7.1% returns year on year. Say you start to invest at 35, by the time you are 50 you would get a huge lump sum from PPF. However, you can also withdraw 50% of your money after 7 years.

- Equities: Investing in equity funds (like ELSS, company shares) is riskier compared to fixed-income schemes like fixed deposits. For instance, ELSS is the only tax-saving mutual fund and it has delivered 14%-18% returns in recent years.

Real Plan:

- Health Insurance: It doesn’t matter which age category you fall under, having health insurance is certainly the best investment one could make. The right state of physical and mental health is indeed better than any investment.

4) Build investment discipline:

You must make sure you stick to the timelines as stringent as possible. Not only that, but you must also find opportunities to make an added investment whenever possible.