In the Game of Thrones, there was one man who was claimed to be the most powerful man in Westeros. Not because he had the biggest army or even the strongest build, it is simply because he had tons of Gold.

Although it might be a fictional story, the idea of Gold making someone powerful is valid to date. Gold has been and will continue to be a safe haven asset. Gold has been used as a currency and a store of value for thousands of years, and its value has remained relatively stable over time.

But as technologies evolved, and so did the people, it is not that people abandoned Gold. It is just that people found various other ways to invest in Gold. In recent years, the rise of Digital Gold has challenged the traditional notion of gold as a physical asset.

In this blog, we’ll explore the differences between Digital Gold and the Physical form of Gold and help you understand the pros and cons of each.

What is Digital Gold?

Digital Gold is the new-age way of buying 24k BIS Hallmark Gold online. It is essentially a digital representation of physical gold that can be traded and held electronically. The value of Digital Gold is tied to the value of actual gold. When you invest in Digital Gold, the asset provider stores the physical form of gold in vaults based on your investment value.

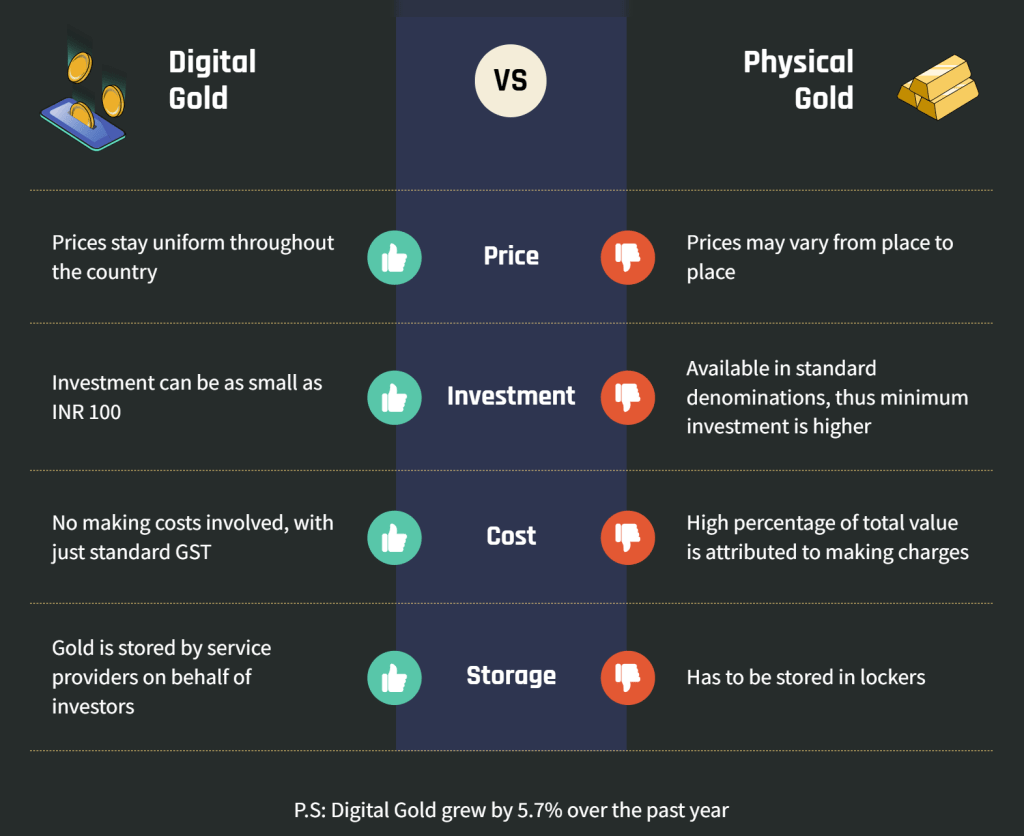

Differences Between Digital Gold and Physical Gold

Accessibility

Digital gold is much more accessible than physical gold. You can buy and sell digital gold from anywhere in the world, as long as you have an internet connection. This makes it a popular choice for investors who want to diversify their portfolios without the hassle of storing gold.

On the other hand, physical gold requires storage and transportation, which can be expensive and time-consuming. You also need to take into account the cost of insurance and security, especially if you plan to store it at home.

Liquidity

Digital gold is also more liquid than the physical form of gold. You can buy and sell digital gold instantly on cryptocurrency exchanges, and the transaction fees are generally lower than those of gold.

Physical gold, on the other hand, can take time to sell, especially if you are looking to get a fair market price. You also need to find a reputable dealer who can verify the authenticity of the gold, which can be challenging.

Volatility

Both digital gold and physical gold are subject to market volatility, but digital gold can be more volatile. The price of digital gold is often tied to the price of physical gold, but it can also be influenced by various other factors.

Physical gold, on the other hand, is generally more stable in price, as it has been a trusted store of value for centuries. However, gold can also be affected by geopolitical events, such as wars or economic crises.

Transparency

Digital gold is generally more transparent than gold. Most digital gold providers provide regular audits and reports on the gold holdings that back the cryptocurrency.

Physical gold, on the other hand, can be more opaque. It can be difficult to verify the authenticity and purity of the gold, especially if you are not an expert. There have been instances of counterfeit gold bars and coins in circulation, which can be difficult to detect.

Since you have a detailed picture, which asset are you leaning towards? If you are interested to invest in Digital Gold. Check out Fello today