Books take you to a whole other world that no other medium of communication could do. Instead of seeing things as they are, books mend a story that is purely based on all your perceived ideas from things that you have consumed all your life. And guess what? The books might be the same, but the way people perceive them is unique for every individual! And that’s the birthplace of ideologies.

Speaking about ideologies, I have spent a whole lot of time reading a lot of novels, poetry, and thought-provoking books over the years. And guess what, I have always shunned away from Finance books because I had this preconceived perception that they are boring. Turns out, they aren’t.

Finance has been one of the most unclear spaces in the world. Had it been clear, we all would be millionaires by now. And here I am sharing my insights on the books I found to be life-changing. And the list goes like this,

- The Psychology of Money – Lessons on wealth greed and Happiness

The book by Morgan Housel covers a wide range of topics, including the importance of patience, the impact of luck, and the role of our personal experiences in shaping our financial behavior.

- What to do With Your Money When a Crisis Hits – Disaster management

This book by Michelle Singletary answers the most pressing questions that crop up when money suddenly becomes scarce, like What bills need to be paid first? When is it right to dip into savings? What are the best ways to cut back on spending?

- A Random Walk Down Wall Street – For Investing Strategies

This book by Burton G. Malkiel emphasizes the importance of diversification and proper asset allocation based on an individual’s risk tolerance and investment goals.

- MONEY Master the Game – A compilation of 50 financial expert interviews

The book by Tony Robbins provides advice on topics such as creating a financial plan, choosing investments, minimizing fees and taxes, and protecting your assets.

- Retire Before Mom and Dad – FIRE

One of the unique aspects of “Retire Before Mom and Dad” is its focus on the emotional and psychological aspects of achieving financial independence written by Rob Berger.

- The Little Book of Common Sense Investing – Stock Market investing guide

The book by John C Bogle’s central argument is that most investors would be better off investing in low-cost index funds that track the overall market, rather than trying to pick individual stocks or actively managed mutual funds.

- Shoe Dog – How an Idea and a $50 loan revolutionized the World

This book by Phil Knight might not be a full-fledged finance book but it is more about entrepreneurship and how wise financial decisions pay.

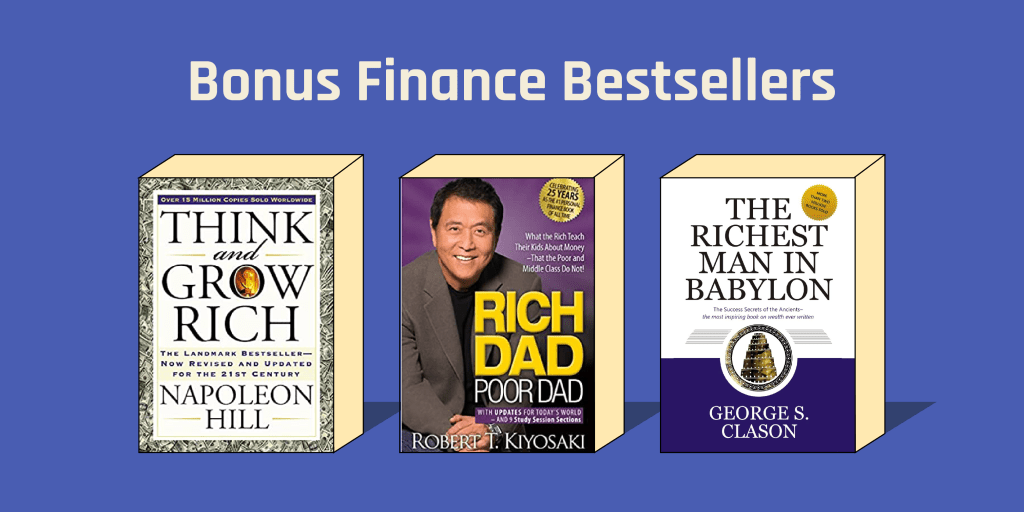

Bonus finance bestseller books!

The book by Robert T Kiyosaki provides practical advice on building wealth, including the importance of investing in assets that generate passive income, such as real estate or stocks.

Napoleon Hill’s work has a core idea, that is success can be achieved by anyone who cultivates the right mindset and habits.

Goerge S Clason’s book tells the story of Arkad, the richest man in Babylon, and how he became wealthy by following simple financial principles such as saving a portion of your income, investing wisely, and living below your means.