A Fixed Deposit (FD) is a popular investment option where an individual deposits a lump sum amount in a bank or financial institution for a fixed tenure at a predetermined FD interest rate. FDs offer guaranteed returns, making them a preferred choice for risk-averse investors.

If you’re wondering “Is FD safe?”, the answer is yes—FDs are backed by banks and insured up to ₹5 lakh under the Deposit Insurance and Credit Guarantee Corporation (DICGC). For alternative low-risk investments, explore Gold Bond Vs FD – Which is the Better Investment?.

What are the Features of a Fixed Deposit?

Fixed Deposits come with several unique features that make them a strong investment choice:

- Guaranteed Returns: FDs provide fixed interest rates ranging from 5% to 8% per annum, ensuring stability.

- Flexible Tenure: Investment periods vary from 7 days to 10 years, giving investors full control over their deposits.

- Interest Payout Options: Choose between monthly, quarterly, or cumulative interest payouts to suit your financial needs.

- Low-Risk Investment: FDs are one of the safest investment options in India, making them ideal for conservative investors.

- Loan Facility: Banks offer loans against FDs up to 90% of the deposit amount, ensuring liquidity when required.

- Tax-Saving Option: Certain FDs offer tax deductions under Section 80C, making them a great choice for tax planning.

- Nomination Facility: Investors can nominate beneficiaries to ensure smooth inheritance.

Who Can Invest in an FD?

Fixed Deposits are available to a wide range of investors:

- Resident Individuals: Any Indian citizen can open an FD account with banks or NBFCs.

- Senior Citizens: Special higher interest rates are available for senior citizens.

- Minors: Parents or guardians can open FDs for minors.

- NRIs: Non-Resident Indians (NRIs) can invest in FDs through NRE and NRO accounts.

- Businesses & HUFs: Companies, partnerships, and Hindu Undivided Families (HUFs) can also open FD accounts.

You can also read: Taxation on Digital & Physical Gold in India

Types of FD

There are many different types of FDs Available in the market. Here are 5 most common types of FDs you can invest in.

1. Regular FD

A Regular Fixed Deposit is the most common type of FD where investors deposit a lump sum for a fixed tenure at a predetermined interest rate. The investment is locked in for the chosen period, and premature withdrawal may incur a penalty. This option is ideal for individuals seeking stable returns with minimal risk.

2. Tax-Saving FD

Tax-Saving Fixed Deposits allow investors to claim deductions of up to ₹1.5 lakh under Section 80C of the Income Tax Act. However, these FDs come with a mandatory lock-in period of 5 years, meaning premature withdrawal is not allowed. This option is best suited for individuals looking to save on taxes while earning fixed returns.

3. Senior Citizen FD

Senior Citizen Fixed Deposits offer higher interest rates compared to regular FDs, typically 0.5% more than standard rates. These accounts are available to individuals aged 60 years and above and provide a secure way to earn better returns on savings. Many banks also offer additional benefits, such as flexible tenure and better payout options.

4. Recurring Deposit (RD)

A Recurring Deposit (RD) is similar to an FD but allows individuals to invest small amounts at regular intervals instead of a lump sum. This type of FD is suitable for individuals who want to cultivate a savings habit while earning interest over time. The tenure usually ranges between 6 months to 10 years, offering flexibility based on financial goals.

5. Flexi FD

A Flexi Fixed Deposit is linked to a savings account, offering the combined benefits of an FD and a regular savings account. It allows partial withdrawals while keeping the remaining deposit intact to earn interest. This type of FD is ideal for individuals who want liquidity while enjoying the benefits of fixed returns.

To understand different deposit options, check out Types of Fixed Deposit (For 2025).

What is FD Interest Rate?

FD interest rates vary based on tenure, deposit amount, and the financial institution.

| Bank Type | Interest Rate (General) | Interest Rate (Senior Citizens) |

| Public Sector Banks | 5.50% – 7.50% | 6.00% – 8.00% |

| Private Banks | 6.00% – 8.00% | 6.50% – 8.50% |

| Small Finance Banks | 7.00% – 9.00% | 7.50% – 9.50% |

Interest rates are subject to change. Use an FD calculator to estimate your returns.

How to Calculate My FD Returns?

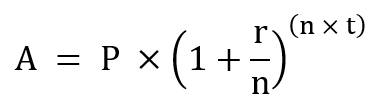

FD returns depend on the principal amount, interest rate, and tenure. The compound interest formula for FDs is:

Where:

- A = Maturity amount

- P = Principal amount

- r = Annual interest rate

- n = Number of compounding periods per year

- t = Tenure in years

Use an FD calculator to simplify this process and get accurate results.

Can I Withdraw FD Anytime?

Yes, but premature withdrawals may attract penalties.

- Regular FD: Allowed with a penalty of 0.5% – 1% on interest.

- Tax-Saving FD: Cannot be withdrawn before 5 years.

- Flexi FD: Offers easy liquidity with minimal penalty.

Fixed Deposits (FDs) are one of the most secure investment options, offering guaranteed returns and flexibility. Whether you are looking for steady income, tax benefits, or liquidity, FDs cater to different financial needs. Use an FD calculator to compare returns and choose the best option for your goals. For further insights, check out Gold Vs Fixed Deposit – Which is Better Investment?.

FAQs

1. Is FD safe?

Yes, FDs are safe investments as they are backed by banks and insured up to ₹5 lakh under DICGC.

2. Is FD 100% safe?

While FDs are low-risk, they are insured only up to ₹5 lakh per depositor per bank. For amounts above this, safety depends on the financial health of the institution.

3. Is FD paid monthly?

Yes, you can opt for a monthly payout FD, where you can earn interest every month.

4. Which type of FD is best?

It depends on your needs:

- For tax benefits: Choose a Tax-Saving FD.

- For high returns: Opt for a Senior Citizen FD or Small Finance Bank FD.

- For liquidity: Consider a Flexi FD.

5. Can I get a loan against FD?

Yes, banks offer loans against FDs, allowing you to borrow up to 90% of your deposit amount without breaking your FD.