To quote the famous words of Albert Einstein, “Compound Interest is the eighth wonder of the world. He who understands it earns it; he who does not, pays it.” Even to this day, stock market veterans such as Warren Buffett give a lot of importance to the compounding effect of money. If you’ve ever wondered why that is, you’re not the first one. And guess what? You won’t be the last one either!

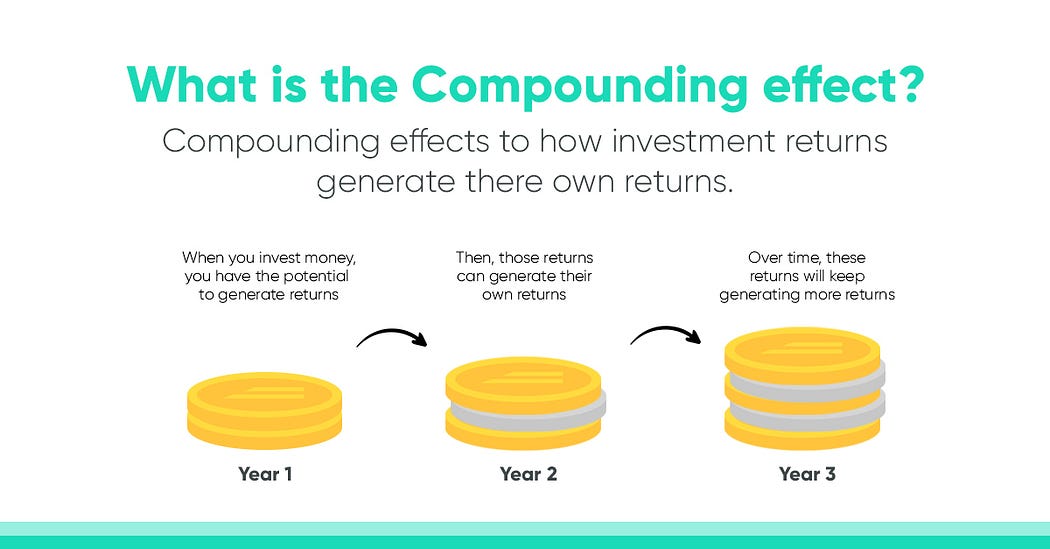

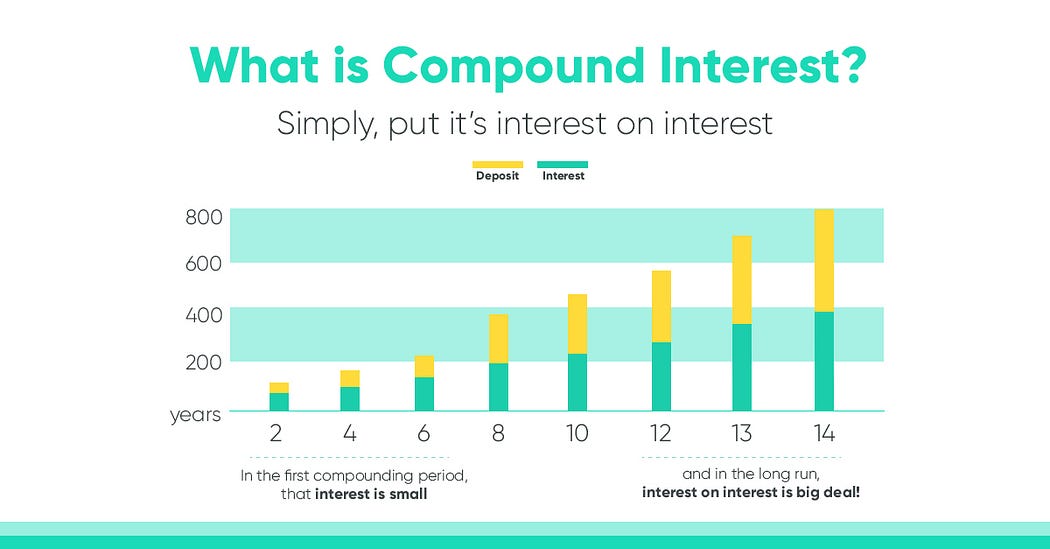

Compounding helps investors grow their small investments at exponential rates to become massive wealth-generating investments in the long run. Undoubtedly one of the most powerful concepts of economics, it works like the multiplier effect of money as the return on investment is constantly reinvested — generating interest on the returns and the principal. Let us look at an example to understand just how powerful compounding can be.

Compounding Effect Of Money – Example

Let us assume you made an investment worth INR 1000 today with a 5% rate of interest. At the end of one year, your investment would stand at INR 1050 — generating interest of 50 Rupees. As time goes on, at the end of the second year, the same investment would equal INR 1102.5 — this time with interest worth 52.5 Rupees. If you leave it untouched, your investment would be worth INR 1629 after ten years. Now that’s what you call growth! Therefore, investing 1000 Rupees today is considerably more valuable than investing the same amount a few years later. To acquire wealth, you must take advantage of the time value of money and the compounding impact of money.

Now, assume you borrowed 20,000 Rupees to buy a car, and your auto loan was for five years at a 10% interest rate. The total cost of your monthly payments would be 424.94 Rupees. However, because the INR 20000 loan compounds over time, you really pay 25496.45 Rupees over the five years, implying that you’ve paid 5496.45 just because you spent the money before you received it. This way, we can see that compounding can work in our favour just as it can work against us. Thus, it’s necessary to keep this in mind while taking financial decisions.

Summing It Up

It’s not hard to see the power of compounding. However, few people truly understand how it can work in their favour. To most people, compounding sounds like magic — the kind of thing that only happens to other people. As a result, most people never take advantage of its effects and let their money grow at just the basal rate of inflation.

If you’re young, or even if you’re not, don’t let your money go to waste like that. Take advantage of the compounding interest rates that come with your investments. You’ll be amazed by how much more money you have after just a few years. But remember, compounding works both ways, so it’s important to take out your savings at least once every few years to invest in something where the compound interest is working for you instead of against you.

Compounding is an amazing tool that allows your savings to grow faster than the base rate of inflation. The simple yet effective phenomenon is so powerful that it can turn mere pocket change into millions of dollars within a decade or so! It is, thus, no small wonder that compounding has been used widely as an effective financial tool for years and has proven time and time again that it’s one of the most potent investment tools available today.