Did you know Indians own around 9-11% of the total physical gold in the world? Yes, doesn’t seem surprising at all looking at the way how Indian households fancy buying gold as an investment.

To contain this, the government of India introduced the Sovereign Gold Bond (SGB) scheme in 2015 as an alternative investment option to physical gold.

The SGB scheme provides a safe and secure way to invest in gold without the hassles of storage and safety concerns associated with physical gold. In this blog, we will discuss the Sovereign Gold Bond scheme in detail.

What are Sovereign Gold Bonds?

Sovereign Gold Bonds are government securities denominated in grams of gold. The bonds are issued in parts, and you can buy them from banks, designated post offices, or stock exchanges. And they have a maturity period of eight years, but you can exit the scheme after the fifth year.

The bonds are priced based on the average price of gold in the preceding three business days from the date of issuance. The minimum investment in Sovereign Gold Bonds is one gram, and the maximum investment is 4 kilograms for individuals.

How are Sovereign Gold Bonds better than actual gold?

- Guaranteed returns: SGBs offer a fixed rate of interest of 2.5% p.a. over and above the capital appreciation, which is not available with physical gold.

- No storage hassles: With SGBs, there are no worries about storage, security, and insurance costs that come with owning physical gold.

- Capital gains tax exemption: SGBs are exempt from capital gains tax if held until maturity, while physical gold is not.

- Nomination Facility: You can nominate your Sovereign Gold Bonds, which is beneficial in case of any unfortunate events.

- Liquidity: SGBs are traded on stock exchanges, making them more liquid than physical gold.

- Transparency: The price of SGBs is linked to the prevailing market price of gold, which is transparent and easily accessible to you.

How to Invest in Sovereign Gold Bonds?

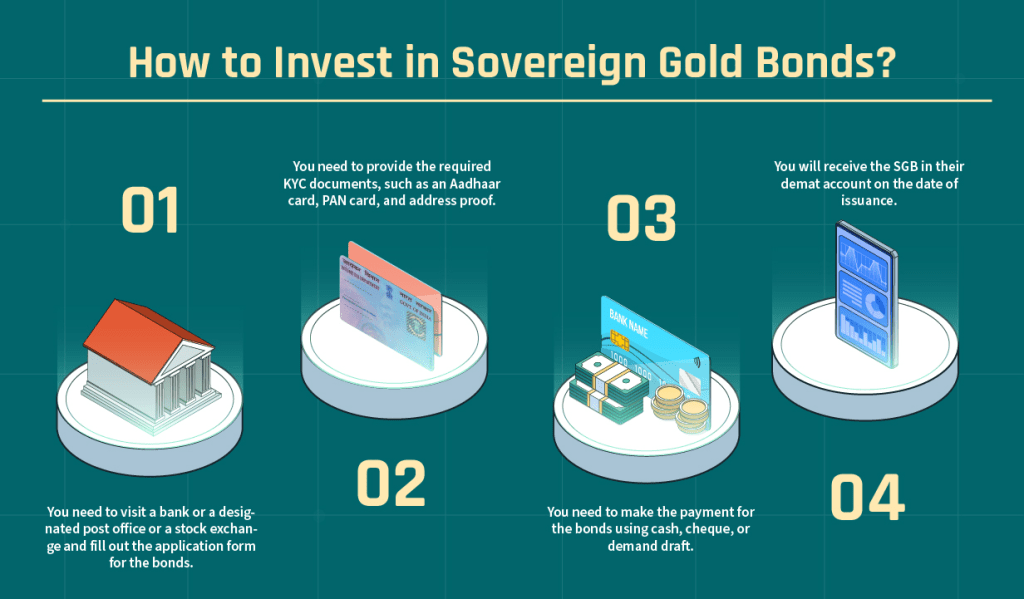

- Step 1: You need to visit a bank or a designated post office or a stock exchange and fill out the application form for the bonds.

- Step 2: You need to provide the required KYC documents, such as an Aadhaar card, PAN card, and address proof.

- Step 3: You need to make the payment for the bonds using cash, cheque, or demand draft.

- Step 4: You will receive the SGB in their demat account on the date of issuance.

Sovereign Gold Bonds Scheme 2022-23: The latest Sovereign Gold Bond Scheme Series IV 2022-23, which opened on March 6, will close on March 10. The nominal value of the bond has been set to Rs 5,611 per gram by RBI. The date of issuance for the same will be March 14, 2023.

And for the upcoming year, the announcement states that the second season of the SGB scheme would start on 22 August and finish on 26 August.

Here’s a comparison of how Sovereign Gold Bond fares in comparison to Gold ETF and Digital Gold! https://fello.in/blogs/goldetf-vs-sovereign-gold-bond-vs-digital-gold/

Conclusion:

The Sovereign Gold Bond scheme is a safe and secure investment option for those who want to invest in gold without the hassles of physical storage. The high-interest rate, tax benefits, and liquidity make it an attractive investment option.