Who wouldn’t like to win prizes? It is ingrained in us to win, to succeed, and prevail as the winner be it in any aspect of our lives. Games have been an integral part of our lives for ages now. They can be broadly classified into games of chance and games of skill.

As the name suggests, your chances of winning the game largely depend on your skill. It helps explore your innate or acquired capabilities and maximize the chance of winning. Chess and Rummy are a few examples of the game of skill. On the other hand, a game of chance’s outcome is mostly out of your control. You’re simply betting on yourself to win it but with no proven skill play. Roulette and Lottery fall under this category.

With this being said, the game of chance comes with risk whereas the game of skill is completely on you and your skill set. We have heard quite a lot of stories where people have lost all their money in games of chance like the lottery and roulette. However, people have won the game of chance and hit the bumper prize but it associates a lot of risk with it.

What if you could play a game of chance, something similar to a lottery without having to lose out on your money?

What is Prize Linked Savings?

This is where Prize Linked Savings comes into the picture. Prize-linked savings (PLS) is a savings program in which a financial institution helps you win bumper cash prizes for streamlining your savings.

A prize is associated with the saving you make. The healthier your practice of saving money, the chances of winning the rewards are high. A culmination of savings and a game of chance is what Prize Linked Savings is all about.

Prize Linked Savings was launched in 2016 on the Walmart money card and ever since that, a few financial institutions like PrizePool, Yotta, Long Game, and Flourish Savings adopted the technology.

The idea behind Prize Linked Savings is to encourage people to save more money by making the savings experience more engaging and rewarding. PLS programs have been implemented in several countries worldwide, including the USA, UK, UAE, etc.

Why is Prize Linked Savings important?

The idea behind Prize Linked Savings is to encourage people to save more money by making the savings experience more engaging and rewarding. Prize Linked Savings programs have been implemented in several countries worldwide, including the USA, UK, UAE, etc. And they are effective in increasing savings rates among low- and moderate-income households.

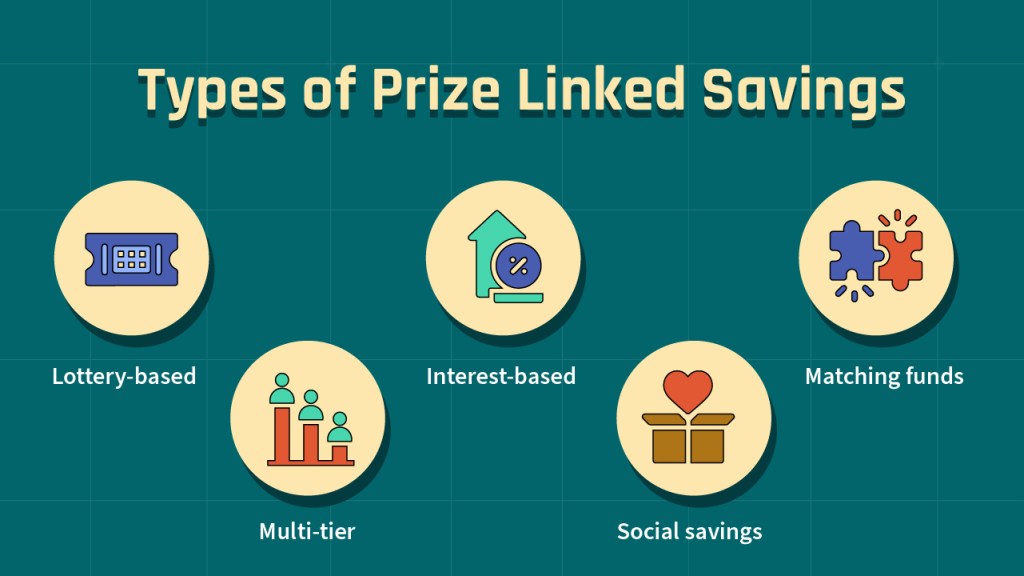

What are the major types of Prize Linked Savings?

There are several types of Prize Linked Savings programs, each with its unique features and benefits. Some of the most common types of programs are:

- Lottery-based PLS: This is similar to a lottery, where savers are entered into a drawing to win cash prizes. The more money saved, the better the chances of winning.

- Interest-based PLS: This type of PLS program rewards savers with cash prizes based on the amount of interest earned on their savings account. The more interest earned, the better the chances of winning.

- Matching funds PLS: In this type, the savers are rewarded with cash prizes based on the amount of money they save. The financial institution will match a certain percentage of the money saved, and the saver can win cash prizes based on the amount matched.

- Multi-tier PLS: Your rewards differ based on the savings tier you fall under. For example, a saver who saves a certain amount of money might be eligible for a small prize, while a saver who saves a larger amount of money might be eligible for a larger prize.

- Social savings PLS: This type rewards savers by giving them a chance to win prizes based on their savings and the savings of other people in the same group. The group’s total savings is the determinant of the prize.

Each of these types has its unique features and benefits, and it’s important to understand the differences between them before deciding which one is right for you.

What are the benefits of Prize Linked Savings?

- Increased savings: Prize Linked Savings can increase savings rates as it makes the process of saving money more engaging and rewarding.

- Safe and secure: You could never lose out on your money. You make the savings in a program and even if you don’t win the Prize, your savings are still safe and will be growing with the market trend or promised percentage.

- Increased customer loyalty: Prize Linked Savings encourages savers to invest their money over a long period and doesn’t urge them to withdraw as they do with other assets. This program allows them to realize the potential of winning prizes grows with their savings.

- Promotes financial education: Young individuals looking to begin their journey of saving can opt for such a program to keep them engaged with the market and also to grow their savings at a consistent rate.

- Legal: PLS programs are legal in most states, but some regulations may vary, so it’s important to choose a trustworthy institution.

Despite the benefits, Prize Linked Savings is a game of chance and often it is viewed as a form of gambling. Based on individuals, the risk factor fluctuates and it is recommended to have supervision who tend to find gambling addictive. However, at Fello, you don’t have to worry about losing money.

Fello’s Prize Linked Savings is as simple as it could be. You keep saving in the assets, you can earn tokens, and keep playing games on the application. And on winning the game, you get to win 10 Million INR. Even if you don’t win, your money is safely invested in one of our assets. Download the application now, and play the game of chance to be a millionaire.