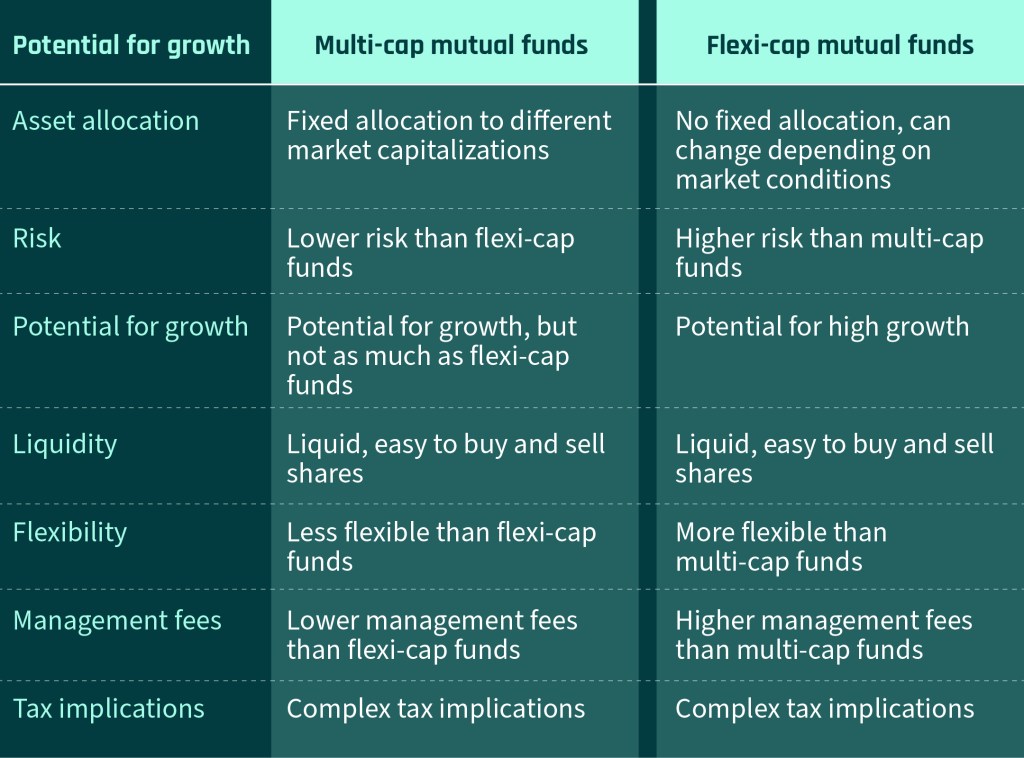

Multi-cap and flexi-cap mutual funds are both types of equity mutual funds that invest in a variety of market capitalizations. However, there are some key differences between the two types of funds.

In this article, we will discuss the differences between multi-cap and flexi-cap mutual funds, as well as the pros and cons of each type of fund. We will also discuss the factors to consider when making a choice between multi-cap vs. flexi-cap mutual funds.

What are Multi-Cap Mutual Funds?

Multi-cap mutual funds are a type of equity mutual fund that invests in a variety of market capitalizations. This means that the fund can invest in large-cap, mid-cap, and small-cap stocks.

Multi-cap funds are a good option for investors who want to diversify their exposure to the stock market. By investing in a variety of market capitalizations, the fund can help to reduce risk.

Pros & Cons of Multi-Cap Mutual Funds

Pros

- Diversification: Multi-cap funds can help to reduce risk by investing in a variety of market capitalizations.

- Potential for growth: Multi-cap funds can potentially provide growth by investing in both large-cap and small-cap stocks.

- Liquidity: Multi-cap funds are typically liquid, which means that you can easily buy and sell shares.

Cons

- Market volatility: The value of multi-cap funds can be volatile, which means that the value of your investment can go up and down.

- Management fees: Multi-cap funds typically have higher management fees than other types of mutual funds.

- Tax implications: The tax implications of investing in multi-cap funds can be complex.

What are Flexi-Cap Mutual Funds?

Flexi-cap mutual funds are a type of equity mutual fund that invests in a variety of market capitalizations, but with the flexibility to change the allocation depending on market conditions. This means that the fund manager can invest more heavily in small-cap stocks when the manager believes that small-cap stocks are undervalued, and more heavily in large-cap stocks when the manager believes that large-cap stocks are undervalued.

Flexi-cap funds are a good option for investors who want to invest in a variety of market capitalizations, but who also want the flexibility to adjust the allocation depending on market conditions.

Pros and Cons of Flexi-Cap Mutual Funds

Pros

- Diversification: Flexi-cap funds can help to reduce risk by investing in a variety of market capitalizations.

- Potential for growth: Flexi-cap funds can potentially provide growth by investing in both large-cap and small-cap stocks.

- Liquidity: Flexi-cap funds are typically liquid, which means that you can easily buy and sell shares.

- Flexibility: Flexi-cap funds offer the flexibility to adjust the allocation depending on market conditions.

Cons

- Management fees: Flexi-cap funds typically have higher management fees than other types of mutual funds.

- Tax implications: The tax implications of investing in flexi-cap funds can be complex.

Factors to consider when making a choice

When choosing between multi-cap and flexi-cap mutual funds, there are a few factors to consider:

- Your investment goals: If you are looking for a fund that will provide growth, then a flexi-cap fund may be a good option. However, if you are looking for a fund that will provide stability

- Your risk tolerance: Flexi-cap funds can be more volatile than multi-cap funds, so if you have a low risk tolerance, then a multi-cap fund may be a better choice.

- Your time horizon: If you are investing for the long term, then a flexi-cap fund may be a good option. However, if you are investing for the short term, then a multi-cap fund may be a better choice.

- Your investment style: If you are an active investor who likes to make changes to your portfolio, then a flexi-cap fund may be a good option. However, if you are a passive investor who prefers to set and forget, then a multi-cap fund may be a better choice.

Way Forward

There is no right or wrong answer when it comes to choosing between multi-cap and flexi-cap mutual funds. The best choice for you will depend on your individual circumstances and investment goals. It is important to do your research and compare different funds before you make a decision. You should also speak to a financial advisor to get their advice. By following these tips, you can make an informed decision about which type of fund is right for you.

Saving is important, and investing your savings is a great way to grow your money and protect it from inflation. Fello is a simple and easy way to save and invest your money, and it makes the process fun and rewarding. Fello is a great avenue to develop a saving habit. The rewards make saving fun, and the investment opportunities make saving even more rewarding. Fello is also a great way to protect your money from inflation. By investing your money in Fello, you can grow your money and keep it safe from the effects of inflation. With prudent investment decisions and patience, you can work towards achieving your financial dreams with these rewarding assets.