Get your Dedicated financial advisor at just ₹3,999 for 3 months

Chief advisors can help you: Answer all your finance related queries

94%

of our clients feel more financially confident

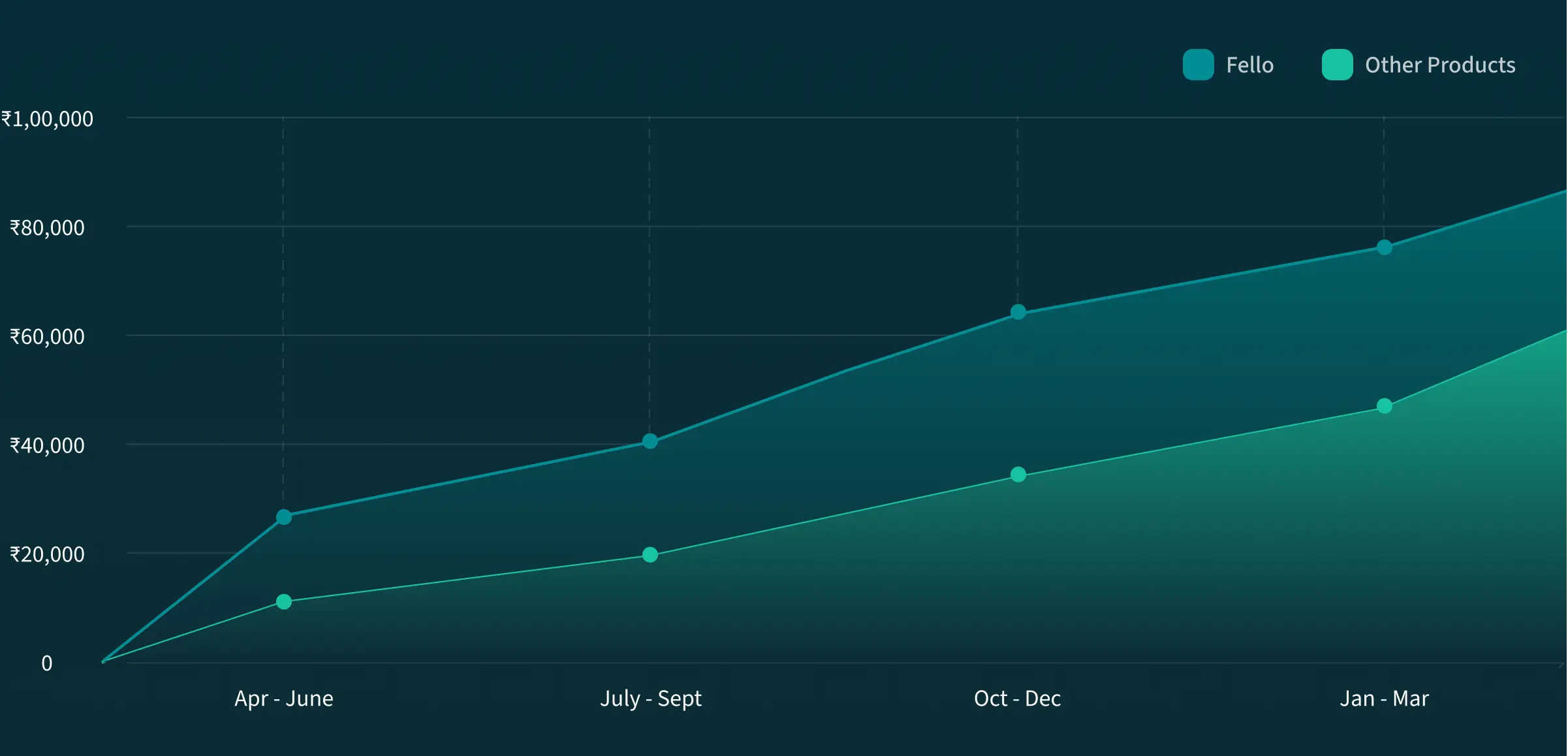

₹55,000

Avg. annual savings achieved by our users

45Cr+

Assets under advisement

WHAT WILL YOU GET

One person to handle everything: Fello Dedicated Advisor

Evaluations

Chief Advisor helps you to evaluate every financial move — from Insurance to investments.

Execution

From paperwork to plan setup, your chief advisor handles execution so you don't have to.

Discipline

Your chief advisor keeps you on track with regular nudges, reviews, and accountability throughout the year.

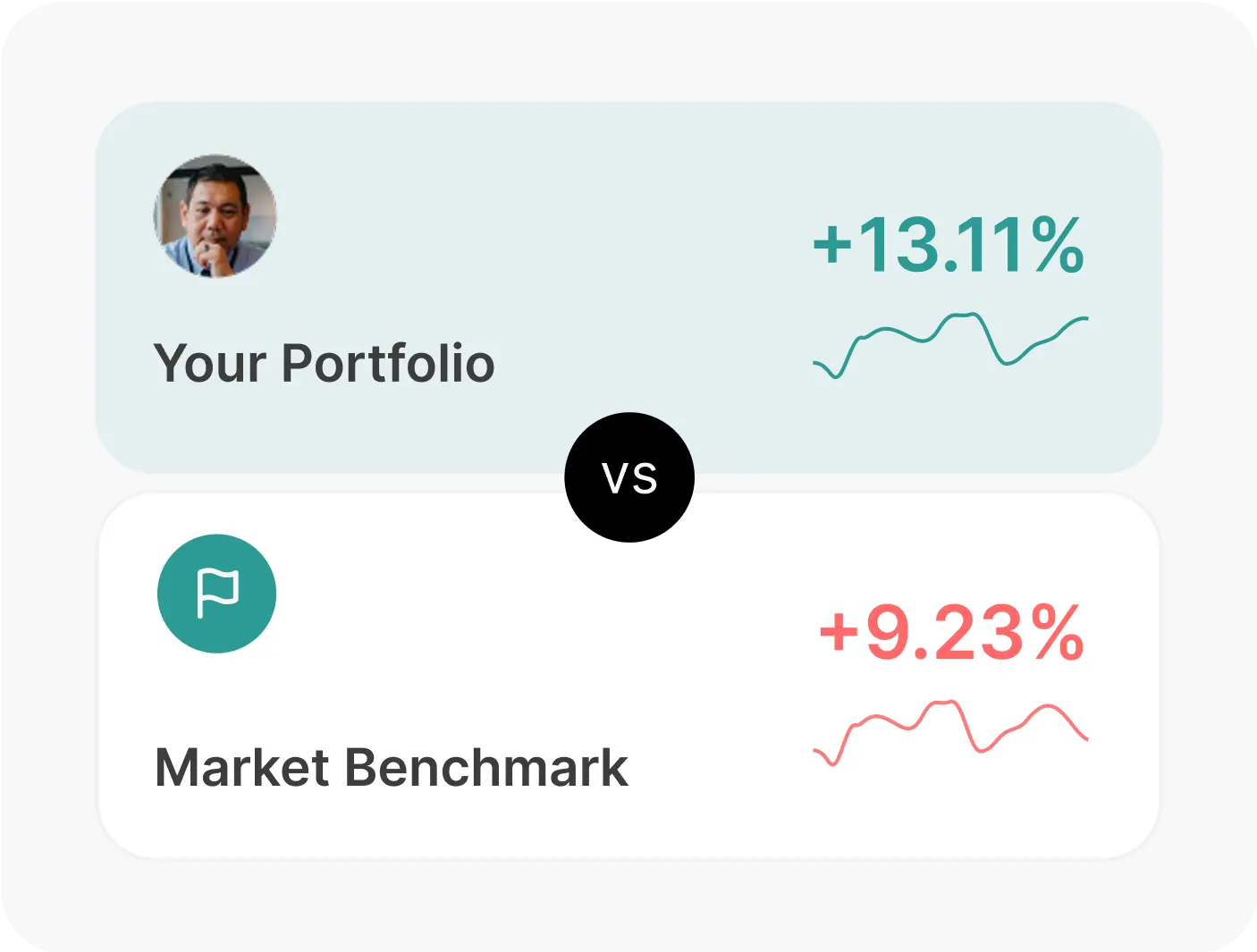

Why do you need a Dedicated advisor

What is different with Fello Dedicated Advisor?

If it’s about your rupee, Fello Dedicated Advisors have got you

Fello Dedicated Advisors take you through

How to get started

Here is how Dedicated Advisor gets you from chaos to clarity

01

Fill out our form

Get started by installing the Fello app on your phone.

02

Buy suitable plan

Choose a financial plan that fits your goals and lifestyle.

Essential plan

Premium plan

03

Advisor allocated in 48 hours

Get matched with a personal financial advisor within 48 hours.

04

Get execution and support

Receive expert-crafted plans and hands-on help to execute them.

Pricing

Choose a plan that best fits your goals

Premium

Complete financial experience, offering entire experience

MEET OUR FINANCIAL EXPERTS

Know your Dedicated Financial Advisor

Shivam Pathak

NISM, PERSONAL FINANCE, 7 yoe

Vijay Agarwal

NISM, Stock Market, 5 yoe

Viral Bhatt

ARN, PERSONAL FINANCE, 18 yoe

Paresh Tapiawala

ARN, MUTUAL FUNDS, 30 yoe

Rajesh Kumar

ARN, insurance, 13 yoe

Devendra Chandra Rai

ARN, STOCK MARKET, 12 yoe

Laxman Agrawal

ARN, Tax Saving, 7 yoe

Rahul Ranjan

FPSB, PERSONAL FINANCE, 23 yoe

Toshavi Dasnurkar

NISM, Wealth Creation, 15 yoe

Neeraj Juneja

NISM, WEALTH CREATION, 28 yoe

Chintan Kamdar

ARN, insurance, 15 yoe

Shivam Pathak

NISM, PERSONAL FINANCE, 7 yoe

Vijay Agarwal

NISM, Stock Market, 5 yoe

Viral Bhatt

ARN, PERSONAL FINANCE, 18 yoe

Paresh Tapiawala

ARN, MUTUAL FUNDS, 30 yoe

Rajesh Kumar

ARN, insurance, 13 yoe

Devendra Chandra Rai

ARN, STOCK MARKET, 12 yoe

Laxman Agrawal

ARN, Tax Saving, 7 yoe

Rahul Ranjan

FPSB, PERSONAL FINANCE, 23 yoe

Toshavi Dasnurkar

NISM, Wealth Creation, 15 yoe

Neeraj Juneja

NISM, WEALTH CREATION, 28 yoe

Chintan Kamdar

ARN, insurance, 15 yoe

Shivam Pathak

NISM, PERSONAL FINANCE, 7 yoe

Vijay Agarwal

NISM, Stock Market, 5 yoe

Viral Bhatt

ARN, PERSONAL FINANCE, 18 yoe

Paresh Tapiawala

ARN, MUTUAL FUNDS, 30 yoe

Rajesh Kumar

ARN, insurance, 13 yoe

Devendra Chandra Rai

ARN, STOCK MARKET, 12 yoe

Laxman Agrawal

ARN, Tax Saving, 7 yoe

Rahul Ranjan

FPSB, PERSONAL FINANCE, 23 yoe

Toshavi Dasnurkar

NISM, Wealth Creation, 15 yoe

Neeraj Juneja

NISM, WEALTH CREATION, 28 yoe

Chintan Kamdar

ARN, insurance, 15 yoe

Shivam Pathak

NISM, PERSONAL FINANCE, 7 yoe

Vijay Agarwal

NISM, Stock Market, 5 yoe

Viral Bhatt

ARN, PERSONAL FINANCE, 18 yoe

Paresh Tapiawala

ARN, MUTUAL FUNDS, 30 yoe

Rajesh Kumar

ARN, insurance, 13 yoe

Devendra Chandra Rai

ARN, STOCK MARKET, 12 yoe

Laxman Agrawal

ARN, Tax Saving, 7 yoe

Rahul Ranjan

FPSB, PERSONAL FINANCE, 23 yoe

Toshavi Dasnurkar

NISM, Wealth Creation, 15 yoe

Neeraj Juneja

NISM, WEALTH CREATION, 28 yoe

Chintan Kamdar

ARN, insurance, 15 yoe

need further clarification?

Have more questions? We’ve got you!

At Fello, all financial consultations are conducted by SEBI-registered experts, ensuring that you receive certified, unbiased, and professional advice tailored to your financial goals. Our experts help with investment planning, tax strategies, and wealth management, so you can make informed decisions with confidence.

Unlike traditional platforms, Fello offers in-house investment opportunities that are carefully curated by financial experts. We provide transparent, high-growth investment options designed to suit different risk appetites, ensuring that your money works smarter for you.

Our SEBI-registered professionals provide personalized insurance recommendations based on your lifestyle, financial situation, and future needs. Whether it's health, life, or asset protection insurance, we simplify the process by helping you compare plans and choose the best coverage without any hidden fees.